It's tempting to be complacent - despite tariffs and the uncertainty, equity indices are in new high ground - as goldilocks go, this doesn't get any better - but the old adage is "buy insurance when you can, not when you need it".

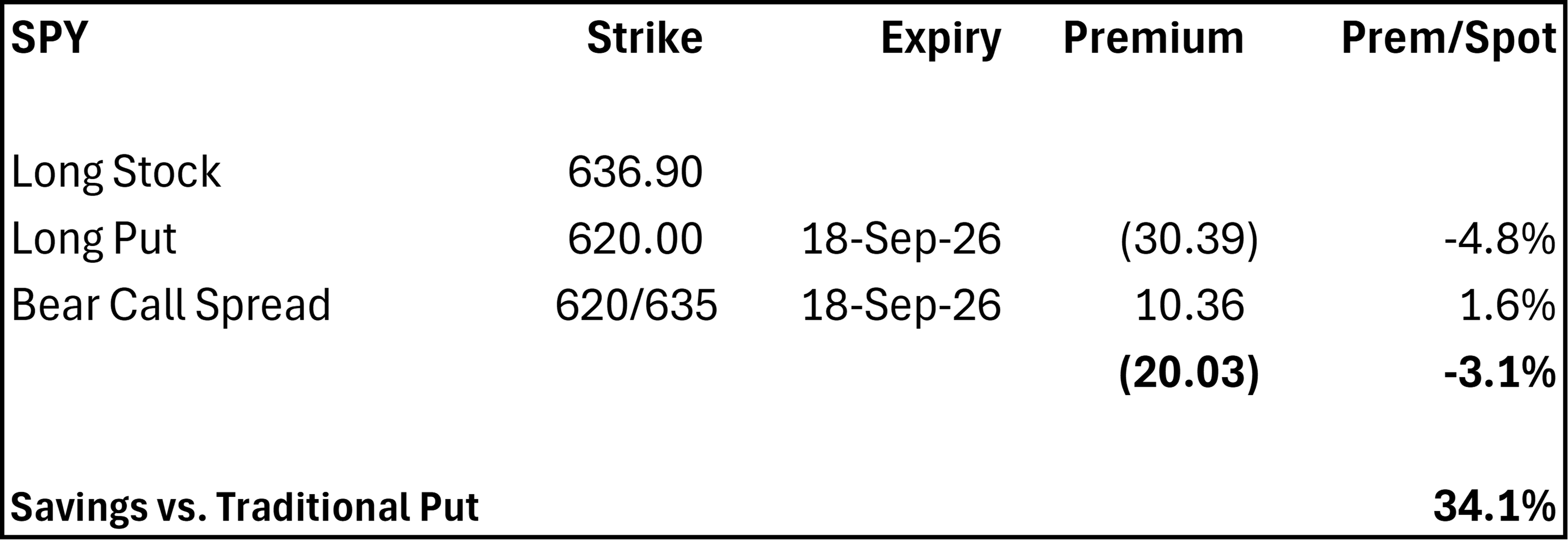

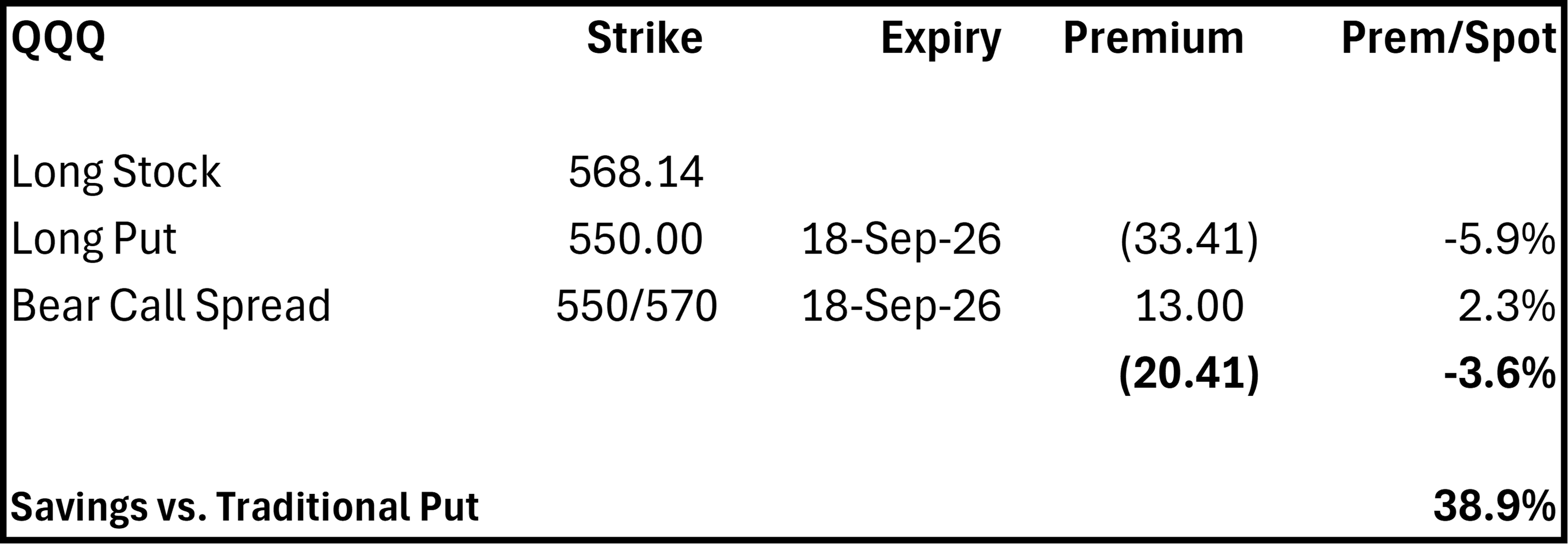

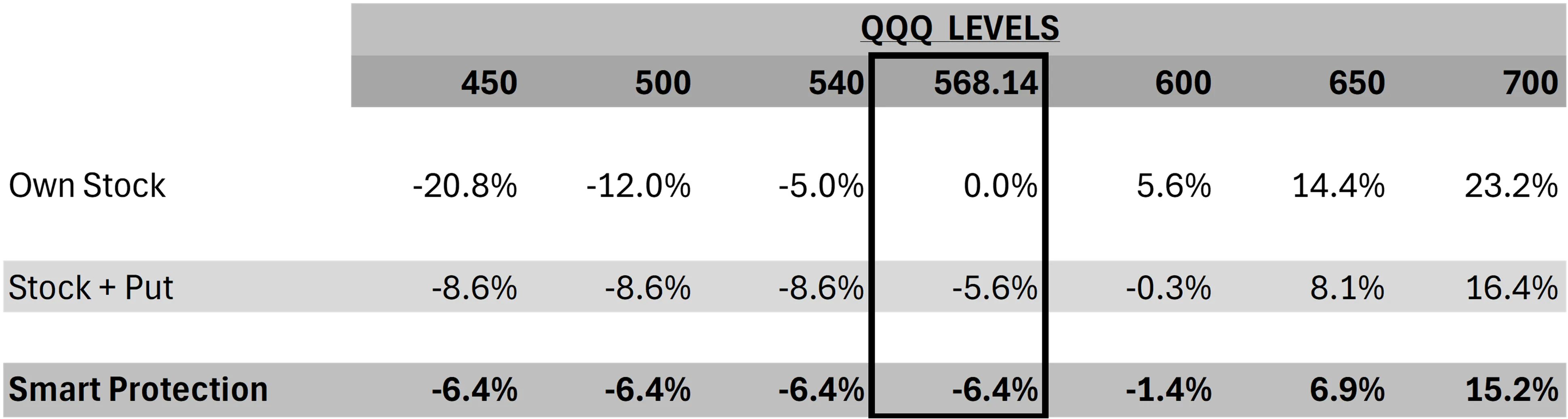

Vols are definitely depressed, making insurance cheap- but is there a smarter (and cheaper) way to buy insurance? In a world of put-call parity, there is no free lunch – but a lower upfront cost is certainly achievable (approx.. 34% lower for SPY and 39% for QQQ for a 97% protection). As with any insurance, there are trade-offs – this strategy is focused on lower upfront costs and more mindful of downside risk protection.

- Priced for both QQQ and SPY. While the examples below are priced for approx. 1 year expiry, trades can be structured for bespoke maturities. Execution efficiency/ liquidity will all play a role.

- Structure is based on listed options offering full flexibility (no lock in) and unlike some structured products, not conditional on other variables.

- While this mimics the pay-off of a long put structure, our focus is on protecting downside at a lower upfront cost, with a view that upside is limited .

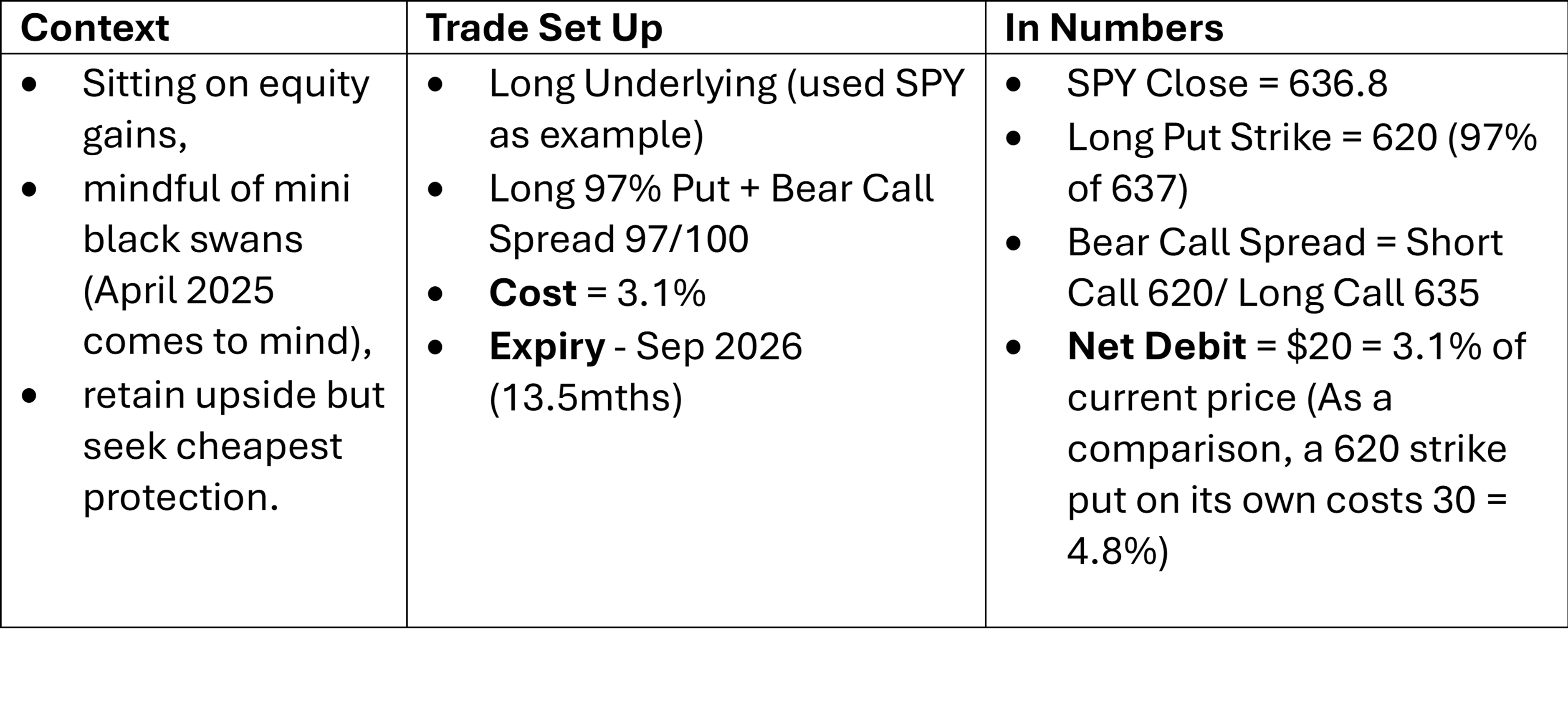

Trade Set Up

source: Lighthouse Canton

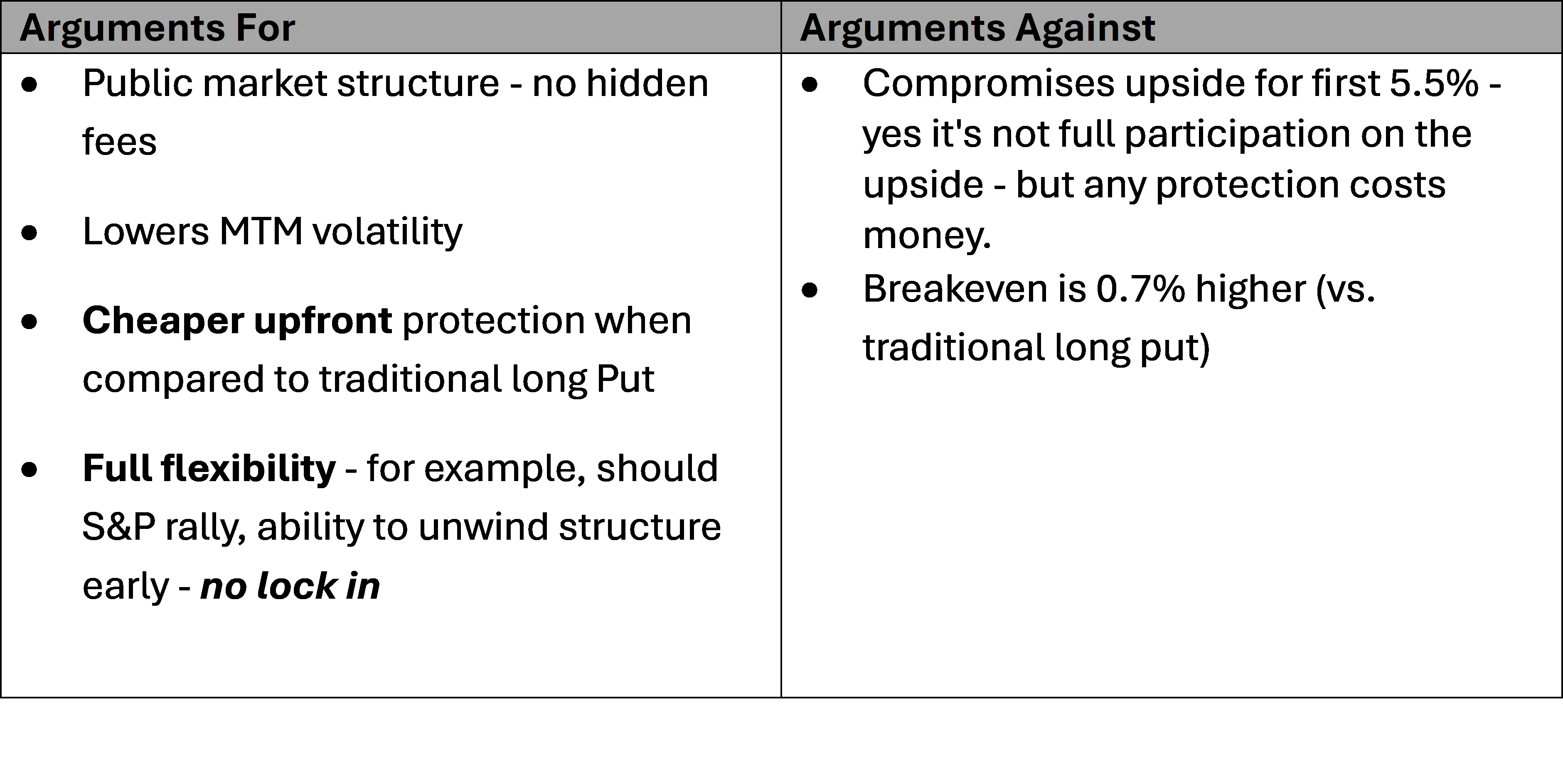

Arguments For & Against

source: Lighthouse Canton

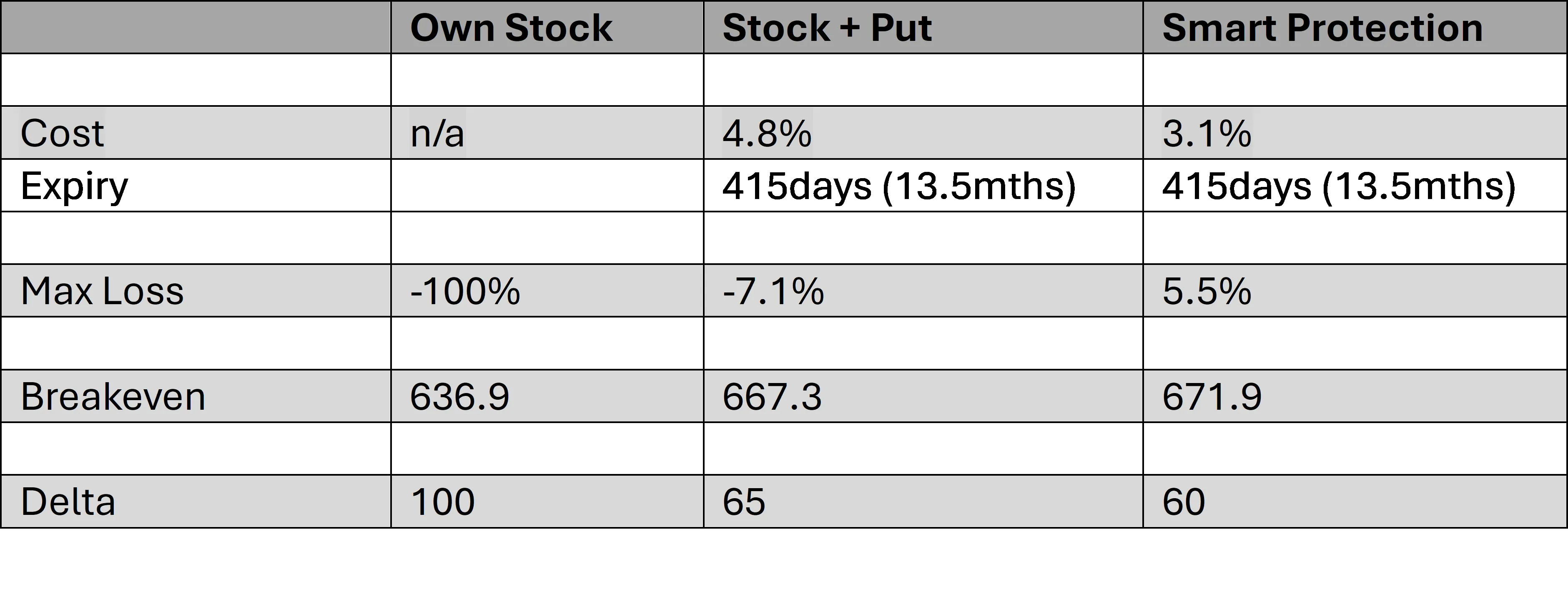

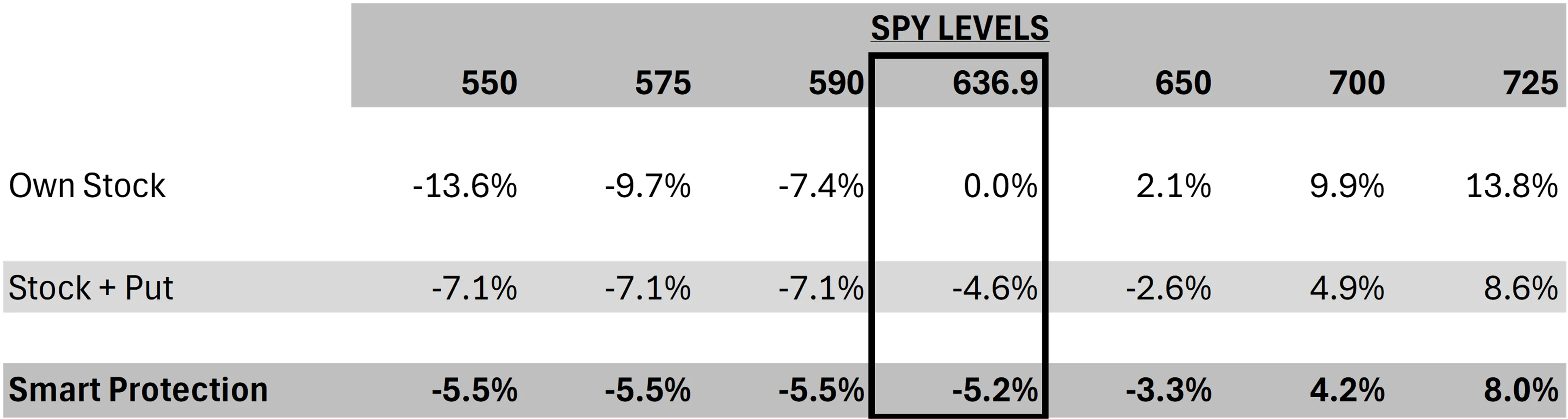

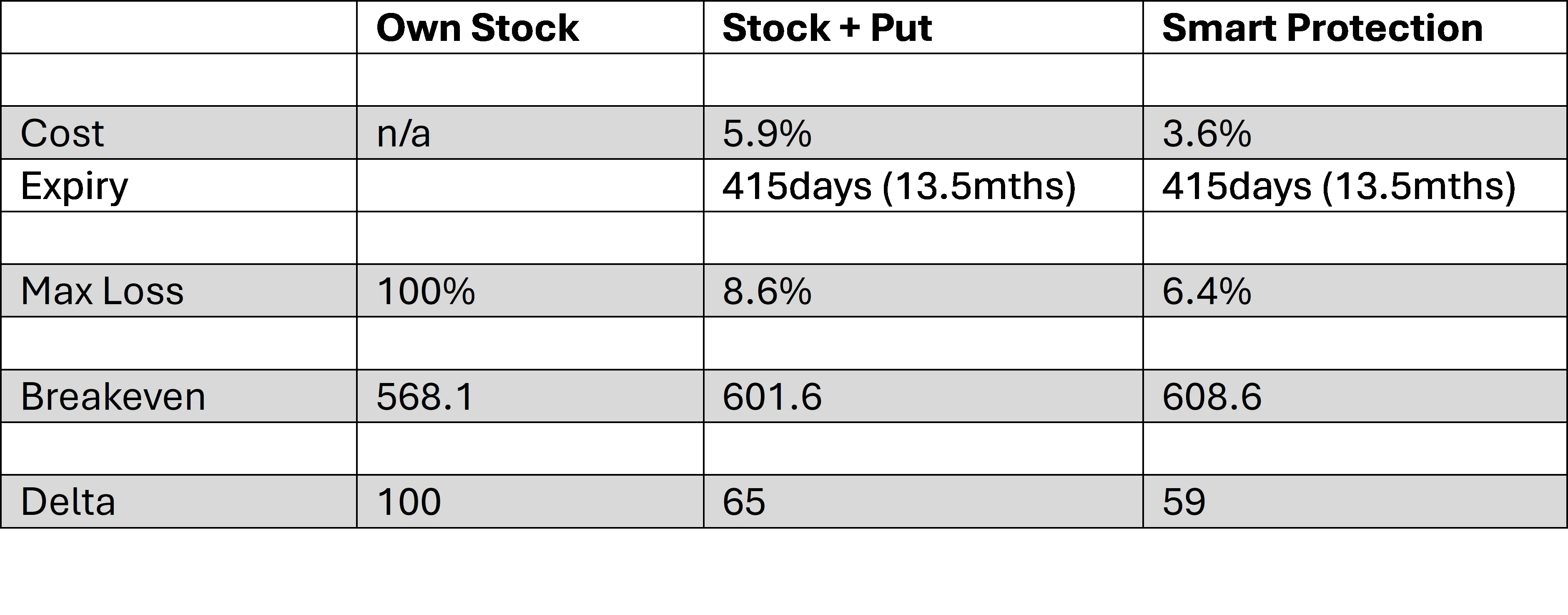

SPY - SUMMARY

source: Lighthouse Canton

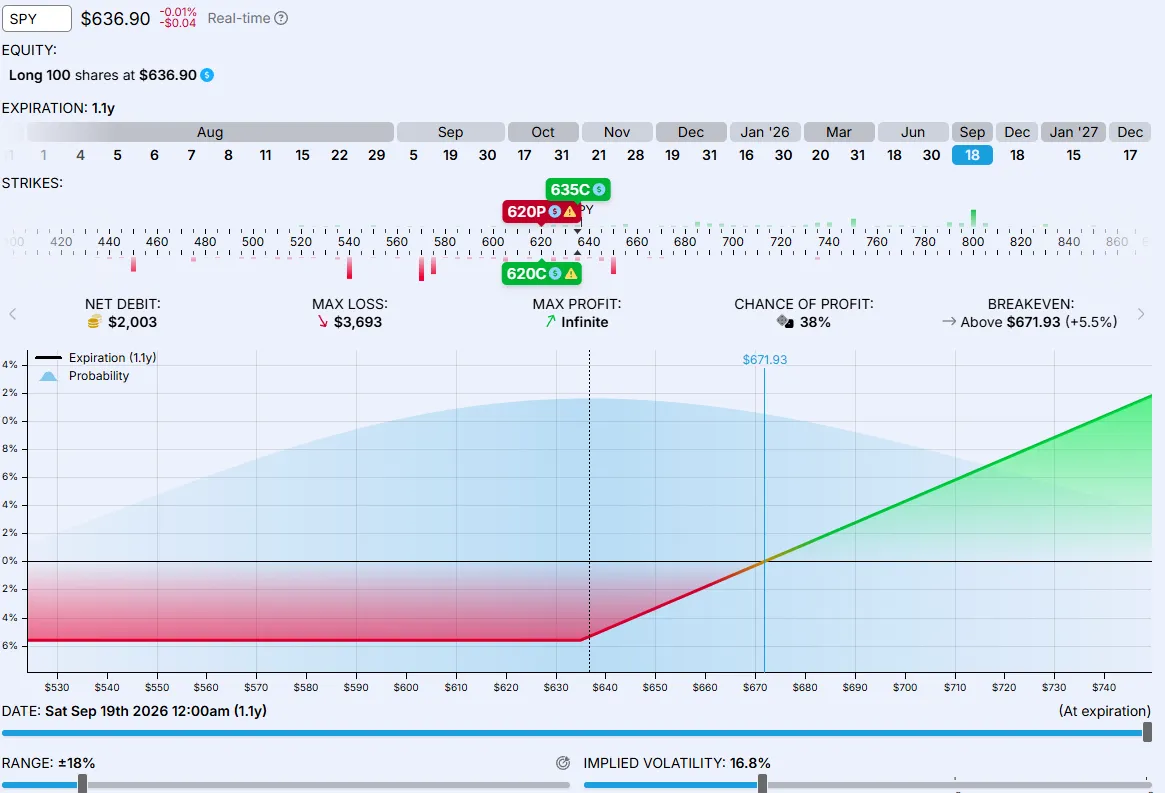

SPY - Payoff

source: Lighthouse Canton

SPY - Premium & Payoff Comparison

source: Lighthouse Canton

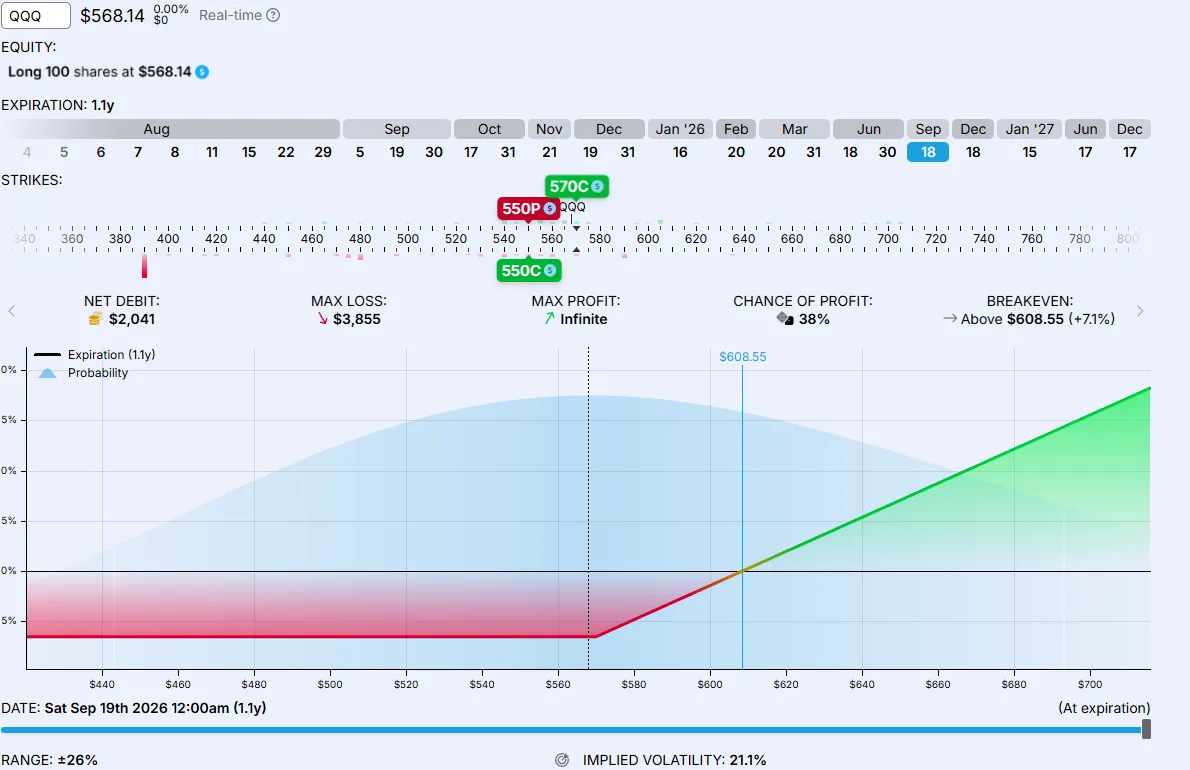

QQQ - SUMMARY

source: Lighthouse Canton

QQQ - Payoff

source: Lighthouse Canton

QQQ - Premium & Payoff Comparison

source: Lighthouse Canton

No items found.

SOME SUGGESTION

View All

%20(29).jpg)

%20(27).jpg)

.jpg)

.png)