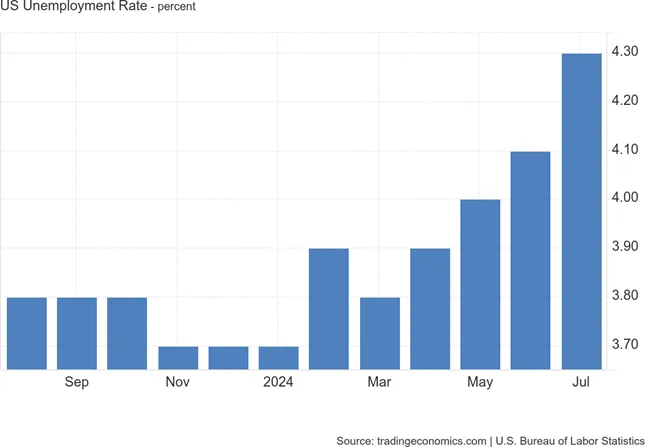

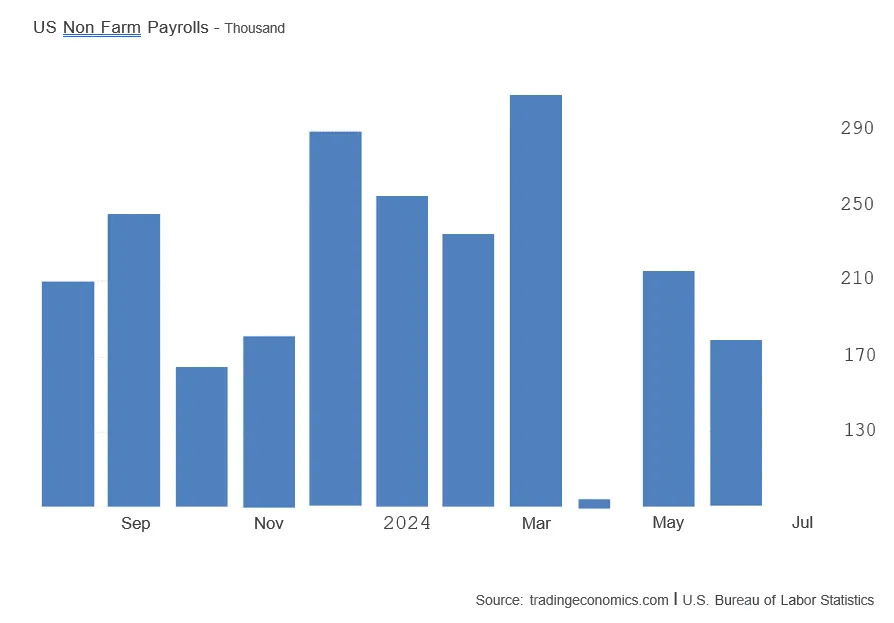

With payrolls at 114K and unemployment spiking to 4.3% missing the mark by a wide margin (consensus 175K; 4.1%), the specter of a deeper than the FED desired soft landing may well now be a real risk. Adding to this will be the real risk of the FED having to move at a faster clip than previously suggested - yet again, a behind the curve central bank appears to have missed an opportunity.

How to Position:

Equities: Short term trends remain bearish (our models signaling an exit mid-July). both the tech heavy Nasdaq and SPX are testing key uptrend line (from Nov'23), defending these levels will be critical for any remnant bullishness. As argued in our note (When the FED Cuts, Cut Your Risk), the case for small caps in a weakening economy does not stack up, and neither do the charts.

Bonds: Expectation of falling rates had already driven down yields, but not materially until the softer economic data really started to hit home. Bonds, especially duration, are now breaking out to the upside, further supporting the case for being long duration.

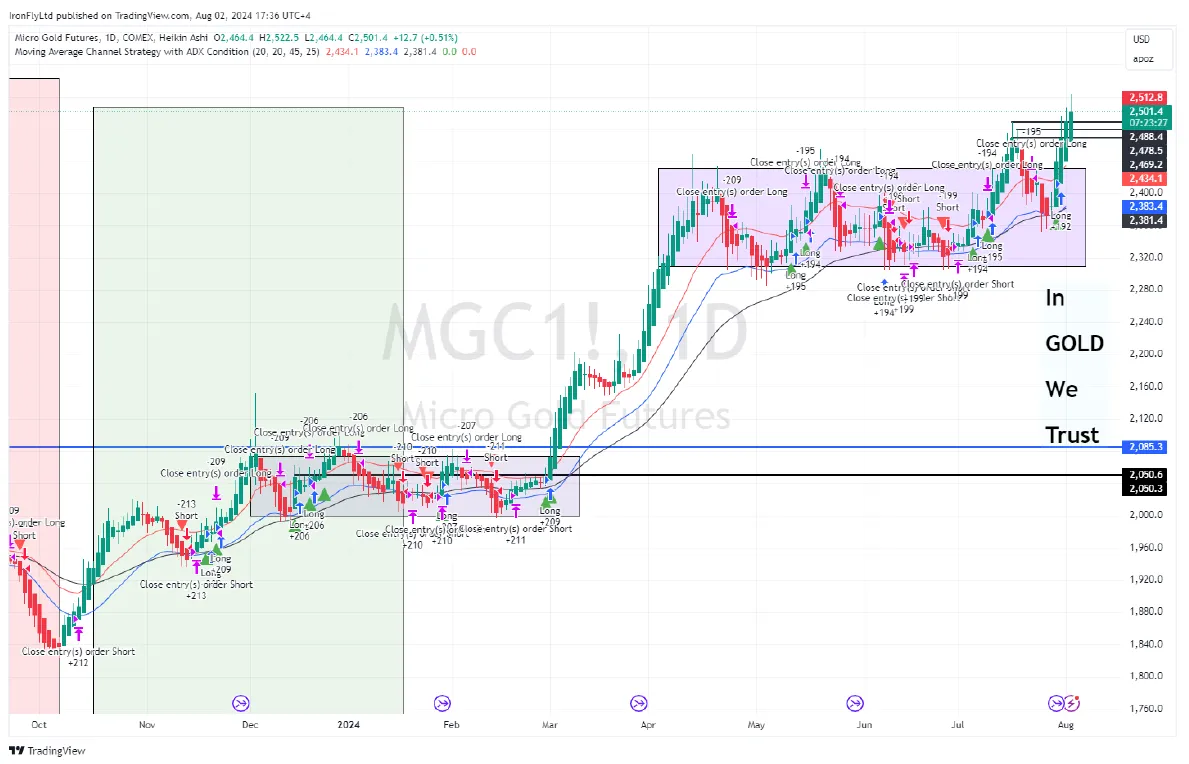

Gold: as argued in our recent report (In GOLD we Trust), Gold's inverse linkage to interest rates is prominent and with yields falling off (and likely to continue down), Gold becomes a beneficiary. Gold's breakout of a 4-month long congestion zone is supporting the upside.

.jpg)

%20(29).jpg)

%20(27).jpg)